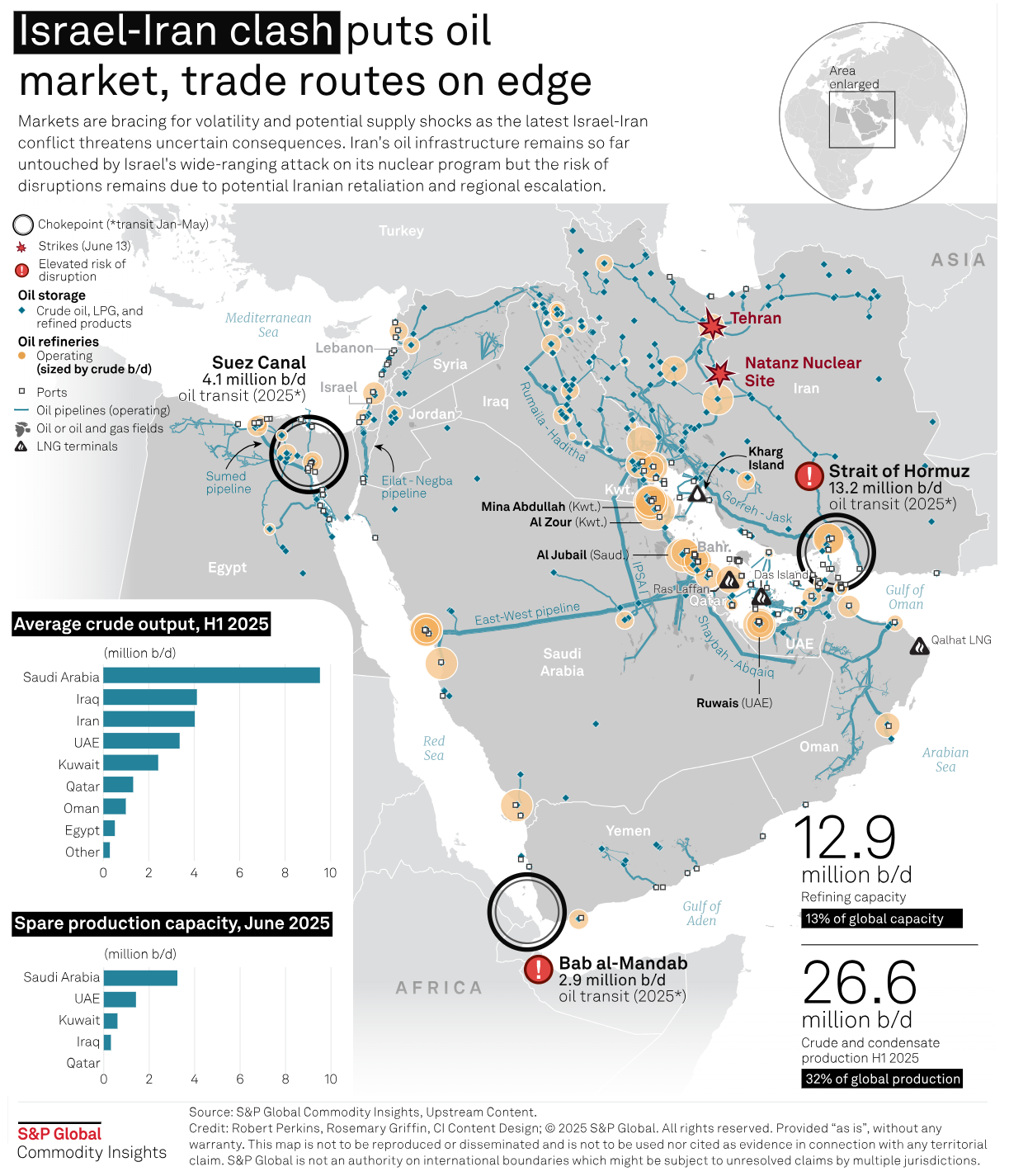

Escalating conflict threatens trade routes via Persian Gulf, Red Sea

Several vessels carrying minor bulk and dry bulk goods in transit

Brazil is a key supplier of corn to Iran

The growing conflict between Israel and Iran is adding a spotlight on the sea routes used for shipping agricultural and metal products after Iran on June 14 warned it will target certain ships near the Persian Gulf and Red Sea if they defend Israel.

Iran and Israel are not major trade players in the global agriculture and metals markets, but their proximity to key sea routes has been creating uncertainty for buyers and suppliers.

A quickly evolving situation between Israel and Iran could potentially support maritime war risk premiums in the Middle East.

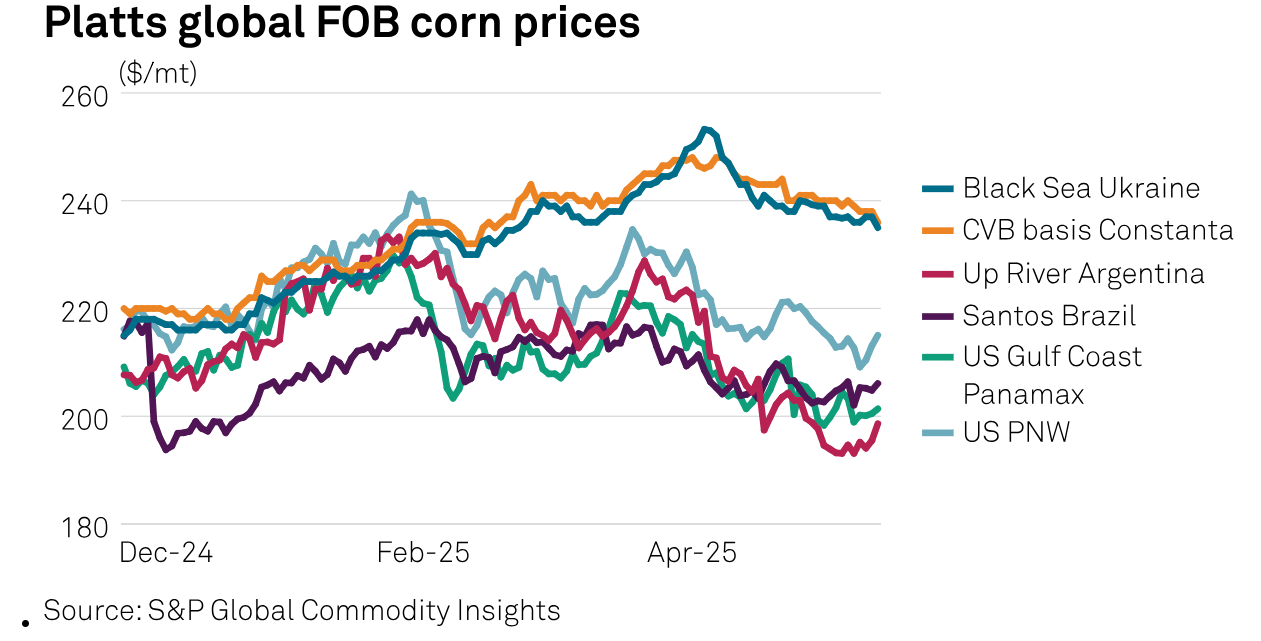

The conflict has already created volatility that has pushed up bunker fuel and consequently freight costs, along with corn cash prices in Asia in the week started June 9.

Trade flows and prices in focus

As of June 15, about 43 vessels with steel products sailed off from Chinese ports were in transit, either using the Red Sea or the Persian Gulf route, according to S&P Global Commodities at Sea data. These ships were loaded over the past month.

About 90 vessels shipping minor bulk products, such as bauxite, alumina and steel are in transit using the two sea routes, with most of the shipments coming from China, the data showed.

China’s steel exports in 2024 through the Red Sea and Persian Gulf routes rose 56% over the year to 18.4 million mt, CAS data showed. China has not shipped any steel to Iran since 2021.

As of June 15, about 80 vessels carrying agricultural products are seen in transit through the Red Sea and Persian Gulf sea routes. These ships were loaded over the past month.

Most of the ships using these sea routes are coming in from Brazil and Argentina, carrying soybeans, sugar, corn and soybean meal

The US, a key global agricultural exporter, has only seven ships currently in transit using the two sea routes, mostly carrying wheat to Iraq.

Iran’s seaborne agricultural imports have fallen since an all-time high of 19.1 million mt in 2022, with purchases falling 38% in 2024, according to CAS data. About 43% of imports in 2024 were corn, mostly shipped from Brazil.

In 2024, overall agricultural shipments using the Red Sea and Persian Gulf sea routes reached 52 million mt, accounting for 8% of the global shipments.

Supply risk premiums have risen recently and provided underlying support for vegetable oil markets, according to S&P Global Commodity Insights analysts.

Soybean oil’s July futures contracts increased 6.30% on June 13, CME data showed, indicating the support emerging from Israel’s announcement to launch strikes on Iran, as these developments could impact upstream energy markets.

Any immediate impact on European flat steel markets was unknown due to the conflict, as European hot-rolled coiled markets were experiencing bearish fundamentals.

The Platts daily aluminum duty paid in-warehouse Rotterdam premium was assessed at a midpoint of $192.50/mt June 13, stable week over week, as the market is taking a "wait-and-see" approach surrounding volatility in the US and growing tensions in the Middle East.